COVID-19 has forced us all to work from home. Some of us may still work from home while paying rent for our office space. Home office deduction is one of the most complicated deductions allowed by the IRS. Still, as long as the rules are met and proper documentation is maintained, you will reap the benefit.

When home office deductions are not kept throughout the year, it’s tempting to push off the deductions for another year due to the headache resulting from the scramble for paperwork.

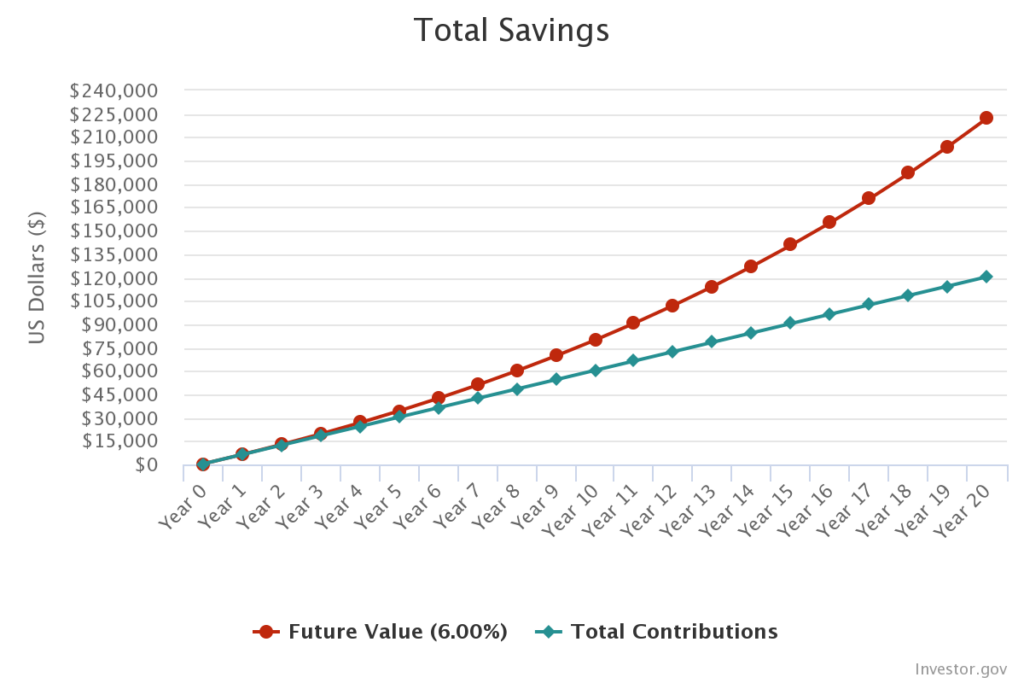

But please don’t push it off this time. The tax benefits you will save multiplied by many years in business will be exponential.

To move away from the fatigue of fishing for home office expense paperwork, start making it a plan now. Checking to see if you qualify for the deduction and gathering the proper documents you need is essential. When tax seasons come, you will be prepared for Uncle Sam. There will be no need to scramble because you would have put proper tools in place beforehand.

Home office deduction is available to both homeowners and renters.

The IRS allows small business owners to choose either the simplified or regular method (standard method).

Starting in January 2013, the IRS introduced the simplified option, which significantly lowers record-keeping pressure. For this option, qualified practice owners can multiply the IRS allowable rate by their home office’s square footage. This method is in place of calculating actual expenses.

The standard method uses the actual expenses of your home office. These expenses include repairs, utilities (electric, internet, water, trash fee, etc.), mortgage interest, rent, homeowner’s insurance, and depreciation.

If your office space is in a room solely devoted to your practice or part of a room, then you will need to figure out the percentage of your home dedicated to your business activities.

Regardless of the chosen method (simplified option or the regular method), two requirements will first need to be met:

- Regular and exclusive use

- Principal place of your business

According to the IRS, you must use part of your home only for conducting business. For example, if you use an extra room to run your practice, you can take a home office deduction for that extra room.

You must demonstrate that you use your home as your primary business place for your business’s principal place. For example, suppose you conduct business at a location outside of your home and use your home “exclusively and regularly” to conduct business. In that case, you may qualify for a home office deduction.

If you are strapped for time and don’t have time to gather the proper records for your deductible home office expenses, the simplified method may be the way to go. But it may not yield the best tax savings for you.

This is where proactive tax planning comes into play and it is not to be overlooked. Figuring out your home office expenses can be done throughout the year and before the end of the year with proper tools in place.

Also, an analysis will need to be done comparing both methods to see which one will be the best choice for minimizing taxes.

From experience, sole proprietors in private practice mainly take home office deductions. However, if your business is an S corporation or a partnership, you can still take the deduction if you qualify.

According to the Journal of Accountancy, accountable plans “work on the simple concept that if reimbursement payments to business owners and their employees are properly claimed and documented, they are not taxable to the recipient… Accountable plans are a flexible tool to incentivize employees to pursue business goals and to facilitate employee-owners’ deductions of expenses they incur in running their businesses.”

For S corporation businesses, an accountable plan will need to be put in place to reap the benefit of claiming a home office deduction. In fact, we assist our clients with this plan throughout the year, so they are prepared and ready to take advantage of the opportunities during tax season.